Below we reproduce an article in Now Grenada in case you missed it.

Debunking myths about myths

8 November 2022

On 4 November 2022, the Grenada Citizenship by Investment Committee, in collaboration with the Investment Migration Council (IMC), hosted a public symposium entitled ‘Demystifying Investment Migration’.

Speakers were Bruno L’ecuyer, Co-Founder and CEO of IMC, and Dr Wayne Sandiford, Member of the CBI Committee.

Unfortunately, I didn’t get to attend the event in person, but did listen online and sent in questions — most of which were, unsurprisingly, ignored. The purpose of the symposium was to speak the truth about CBI, educate the public, debunk the myths. Did they achieve these objectives? Hardly. It did however make for riveting listening, as much for what was disclosed, as for what wasn’t.

We know who and what the CBI Committee is, but what about IMC — who are they? According to its website, IMC is ‘… the worldwide forum for investment migration, bringing together the leading stakeholders in the field.’ In other words: a lobby group. IMC’s corporate donors include firms across the citizenship-by-investment industry. As of March 2021, there are over 25 corporate donors and over 450 individuals that contribute to the funding of the IMC. So despite its impressive-sounding title, IMC is not impartial — far from it. Its interests are in pushing the agenda of the investment migration industry, and its members are major players in the industry, all of whom have large vested interests.

L’ecuyer kicked off proceedings by placing CBI in a global context, where we learned that we are not alone. The investment migration industry is new, most CBI schemes are no more than 10-15 years old. The sector has seen spectacular growth and equally spectacular flows of funds, upwards of US$15 billion annually. Eighty sovereign states have some sort of investor migrant programme, including the UK and USA.

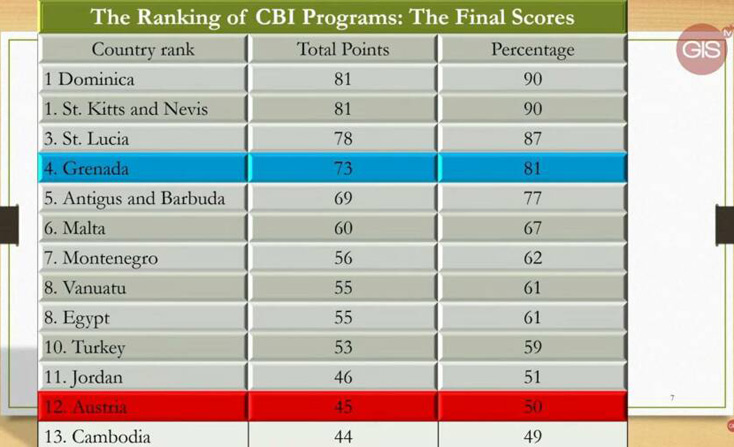

Now here’s the best part: according to IMC, Grenada has a very good CBI programme, ranked 4th in a survey done by themselves. Wow that’s great, isn’t it? Well yes, until you take a closer look at the competition. First of all, only 13 countries are included in the ranking, so it’s hardly a global sample. Secondly, when you look at the countries included, none of them would make Transparency International’s most corruption-free list. Much is made of the fact that IMC ranks Grenada higher than Austria, ranked a lowly 12th. ‘See? We’re even ranked higher than a European country!’ Maybe that’s because Austria has one of the most selective CBI programmes in the world — and expensive: minimum investment of US$9.5 million required. Very few people are granted citizenship, therefore, not many fees to be made from Austria.

Malta is another European country that operates CBI, a dubious scheme riddled with corruption allegations and which is getting the island nation into no end of hot water. In September 2022 the European Commission took Malta to the Court of Justice of the European Union, stating that granting EU citizenship in return for payments without any genuine link to the Member State is not compatible with the principles of the European Union. Maltese journalist Daphne Caruana Galizia was murdered in a car bombing on 16 October 2017, after she had been investigating Malta’s CBI scheme, including Henley & Partners, passport agents for Grenada, St Kitts, and many others.

But what really made me sit up and take notice are the 2 countries ranked joint first: Dominica and St Kitts & Nevis. These 2 CBI programmes are almost perfect, with a 90% ranking:

This is actually funny: laughing out loud, falling on the floor, funny. Why? Because St Kitts & Nevis is the poster child for a dysfunctional CBI scheme. The last time I was in St Kitts, in 2018, I was impressed with the amount of sparkling new villas and condos dotted along the hills overlooking Frigate Bay, until I found out that most of them are empty! In a loophole to the CBI law, applicants have been able to receive their passports before the real estate is constructed, leading to a number of unfinished CBI approved projects. In addition, St. Kitts is notably lax in its due diligence. These are just a few of the rogues’ gallery granted St Kitts & Nevis passports:

- Sudheer Sriram. Original Nationality: Indian. Accused by Indian authorities in 2009 of being the mastermind behind a $250 million scam. In 2013, he had an Interpol red notice issued against him. Sriram fled after the scandal and applied for a St Kitts and Nevis passport in 2011. The application was initially rejected but subsequently approved. Sriram was arrested in India in 2018.

- Seyed Ali Sadr Hashemi Nejad. Original Nationality: Iranian. Former chairman of the disgraced Pilatus Bank in Malta. In 2018 he was arrested in the US on charges of sanctions evasion, money laundering, and bank fraud, which led to the European Central Bank shutting down Pilatus Bank.

- OlawaSeun Ogunbambo. Original Nationality: Nigerian. Arrested in 2012 by Nigerian authorities in connection with an oil subsidy frau. He was twice denied bail in 2012, due in part to his multiple passports. In 2021 authorities continued to seek Ogunbambo after he allegedly fled the country after skipping bail.

- Hussain Ali Habib Sajwani, Original Nationality: Placed on a Canadian sanctions list in 2011 for corruption. In 2011, Egyptian authorities convicted Sajwani in absentia for his role in a land deal and sentenced him to 5 years in prison. His name was included in the Egyptian Financial Supervisory Authority’s list of prohibited persons.

This is what IMC calls ‘near-perfect’? They evidently have a strange idea of what constitutes perfection. Or could it be that the agency that does this ‘objective ranking’, is, actually the lobby group for the industry, loaded with conflicts of interest?

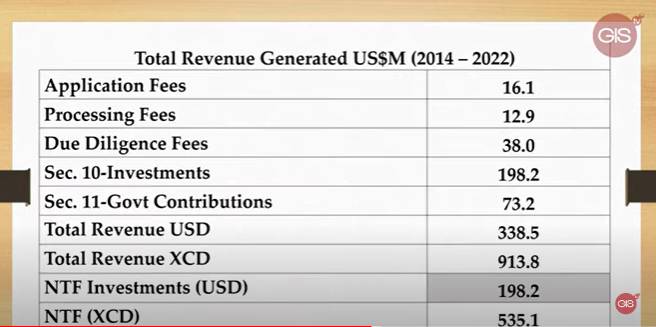

The symposium was then presented with data on the economic contribution of the CBI programme to Grenada. This was a mixture of fact and fiction. Facts are the CBI inflows into the National Transformation Fund (NTF), and fees paid to the government. Over the period 2014 to 2022, total revenue to the government amounted to US$536.7 million, or EC$1,448.9 million, an average of EC$161 million per year. This is a significant sum, and is to be applauded.

But we are told this is small change, compared to where most of the CBI money goes: real estate:

These are indeed eye-watering numbers, it would appear that over the period 2014 to 2021, CBI has netted Grenada US$3.6 billion in foreign investments into approved CBI projects. However not all this planned investment has been realised; to date a total of US$1.5 billion has been spent on actual investments. US$1.5 billion is a lot of money, the type of money that makes an impact, the type of money you can see. Do I see US$1.5 billion of CBI investment in Grenada? No. I see developments, for sure: La Sagesse, Silver Sands and Kawana Bay are large construction projects but nowhere near US$1.5 billion.

One of the few questions I did get answered was: How are these figures generated, are they based on audited financial statements? No, they are not. Developers simply report to CBI their actual investments. Like my ex-boss used to say, himself an auditor: ‘Unaudited numbers are just that: a bunch of numbers.’ Highly fictitious numbers too. For example, the Levera developers claim they have spent US$70 million so far — what a joke. When I visited the site 3 months ago it was deserted save for a few rusting pre-fab huts. Moreover, as noted in My Top Ten Beefs With CBI: The CBI is a flawed financing model; because the people who ‘invest’ in the hotel aren’t too bothered about its future profitability — they’re just buying a passport, anything else is gravy. This is a recipe for the creation of white elephants, like the empty villas that blight the landscape in St Kitts.

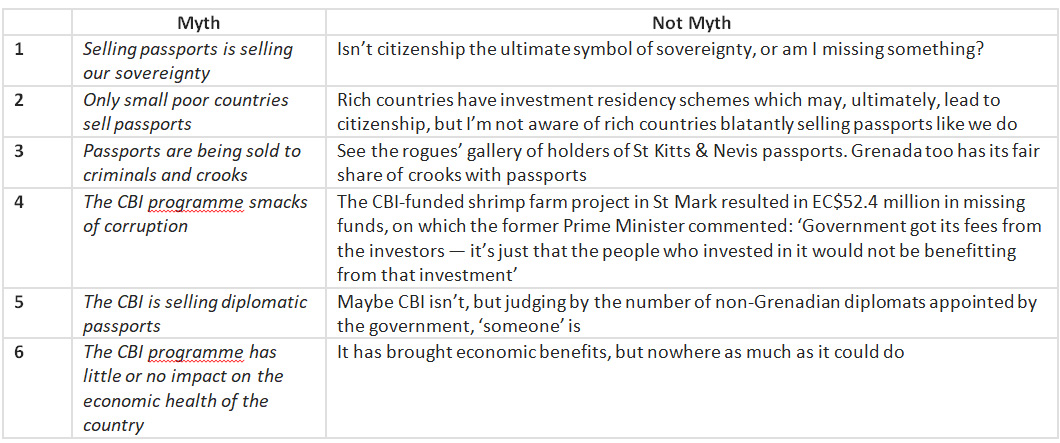

Busting myth busters – responses to the 6 ‘myths’ about CBI:

If Grenada is to continue to sell passports, I suggest 3 structural changes:

- Significantly increase the price per passport

- Sell fewer passports, and

- Scrap the real estate component.

Imagine if all that money had gone to government’s budget, instead of into dubious real estate schemes? Imagine the healthcare that CBI funds could pay for, the new schools, the new roads, the social safety net. This would be a far better use of funds than pouring money into projects which have a slim chance of ever achieving economic viability.

In the spirit of openness and transparency, the objectives of the symposium, I request, heck I demand, written answers to the following questions:

- How many passports have been issued under CBI, broken down by country of origin?

- How many of those new passport holders are resident in Grenada?

- What is the breakdown the actual investment of US$1.5 billion, by project?

- What is being built at Mount Hartman?

- What is the legal status of the Kawana Bay project?

- What is the status of the Levera project?

In our rush to sell as many passports as possible, have we considered the demographic implications? Grenada sold 1,058 passports from January to September 2022, equivalent to 1,410 new passports per year. Most sales are to nationals of China, Russia, India, South Africa, and Nigeria; all countries with high social, political and economic risk factors. What will happen if and when these countries implode, any more than they already have? Is Grenada prepared for a deluge of rich refugees? London aka Londonistan is reeling under the effects of its investment migration policies: sky-high property values and empty luxury apartment buildings. Grenada is already feeling the effects: rising land prices which are squeezing out first-time Grenadian house buyers. Where will this lead us, in 10 more years?

Investment migration is a new global industry, and in its infancy already displays similar characteristics to another global industry: the arms trade. Both are secretive, where the main players are high net-worth individuals who don’t want their business made public, where middlemen make exorbitant fees, and where there is minimal due diligence. Pardon the double metaphor, but we are babes in the woods, swimming with sharks.

In closing, a word of advice to the CBI Committee: when you’re hosting a public symposium with the stated objective of educating the populace; leave your arrogance at the door. The concerns of ordinary Grenadian citizens are not ‘noise’, and criticisms of the programme are not ‘myths’. When you bandy these terms about you are not educating the people; you are alienating them.

Comments

We posted this comment but, as usual, Linda Straker refuses to publish our comments. We would like to know more about her and her interests if anyone can help please.

Excellent analysis. Government needs to pay attention.

OK so CBI generated EC$112m in nine months. That’s the upside.

But was anyone at this meeting concerned with the downside? First Grenada’s reputation has been trashed. The world sees a desperate little country taking bribes, pandering to dubious foreign individuals and displaying weak financial probity and due diligence. Who wants to invest there? Shady businesses looking to take the CBI money – and criminals. And no matter what Mr Duncan, CBI Chairman says, the world does not differentiate between Grenada selling passports and Grenada selling diplomatic passports. And we know where that has led. The US, UK and EU are moving to close down this easy entry to their countries by the back door.

http://www.coralcovegrenada.org/2022/06/18/life-after-citizenship-by-investment/

Second this money has been used to start hotel developments most of which are highly dubious and unlikely to be completed. It’s not just CBI’s lack of proper vetting of passport applicants but also lack of vetting of the hotel developers government is allowing to receive the applicant’s money. All of the five big proposed hotels projects are in court. Four of them have no clear planning consent to build anything! CBI is implicated in the selling of hotel rooms and apartments that are as yet not legal and may never be. Who will customers sue when what they bought into doesn’t exist? It will rebound on government of course where shady developers have disappeared leaving us with destruction and sometimes concrete shells in prime nature areas. We have drawn CBI’s attention to this twice but have not been blessed with a response. http://www.coralcovegrenada.org/2022/09/19/why-has-the-proposed-coral-cove-hotel-been-given-cbi-status/

If the NDC government really needs to continue with selling our passports we need a proper meeting please at which these issues can be discussed openly and hearing views against as well as from the vested interests of the CBI industry responsible for the meeting reported on here – the Investment Migration Council, a self appointed trade body based in Switzerland whose objective is to promote CBI programmes and make money for its members. And Mr Samuel is so right – the whole programme must drop the real estate component. As it stands, CBI is a licence for shady developers to despoil our natural assets using other people’s money with nothing stopping them siphoning off most of it. And there is no assurance that they will complete what they start and no effective redress if they don’t. Just more liability and risk for Grenada.